-

Posts

3,070 -

Joined

-

Last visited

-

Days Won

12

Content Type

Profiles

Forums

Events

Everything posted by Moses

-

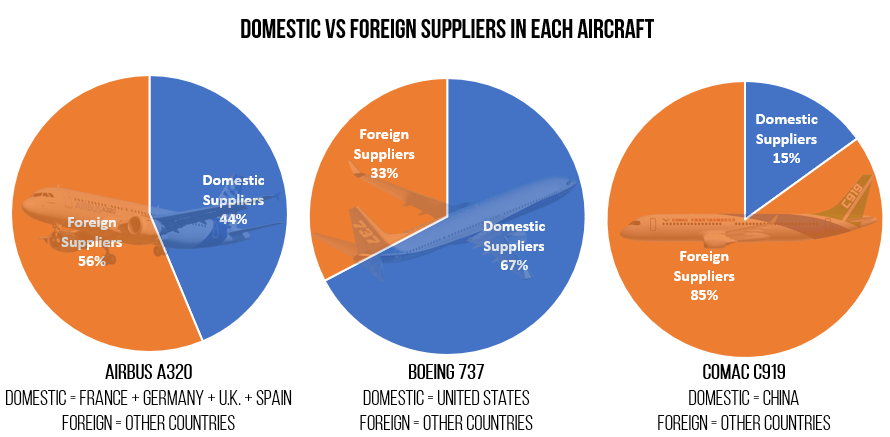

In the official list of Airbus suppliers https://www.airbus.com/sites/g/files/jlcbta136/files/2023-04/Airbus-Approved-suppliers-list.pdf from China 220 companies, South Korea 198 companies India 176 companies Morocco 128 companies Tunisia 86 companies Turkey 50 companies Malaysia 30 companies Thailand 20 companies Around 18% of all A320 and A321 are assembled on 2 final assembly lines in China

-

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

Dear, you know that going on to the opponent's personality means that you have no arguments on the merits of the dispute? And, besides, it shows a low level of discussion culture. -

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

Stevie, dear, are you alive? Great, otherwise you've been silent for 7 days and I have no one left to tease. That's not right, don't do that again or I'll scold you! What happened to you? Is everything okay? I'm worried about you: bringing information from two weeks ago here as "news" looks ridiculous. These two weeks have seen a sharp turn in the trends, because Putin's warning worked: Zelensky's "victory plan" that he brought to the UN General Assembly was rejected with skepticism by grown-ups. Scholz said that Ukraine would wait 30 years for NATO membership, and Biden, Harris and Trump all tried not to promise little Zelensky anything. And today's FT has a big article analyzing the situation and telling us that Zelensky returned hysterical, blamed the entire military leadership for his defeat and in the coming days will replace the Minister of Defense, the Chief of Staff and the Chief of Intelligence. And this is because at the meeting with adults he could not show a single success of the Ukrainian army over the past 2 years. Therefore, Zelensky was sent home to study his lessons and was ordered to return for the exam on October 12 at the Ramstein base with realistic plans. The FT calls the main realistic European plan Ukraine's refusal of the territories already occupied by Russia, fixing the borders and further negotiations through diplomatic channels. -

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

There is a character in Russian folklore called Zmey Gorynych, he looks like a dragon, only with more necks and heads. And there is a joke about him, in which in the morning all the heads except one swear at her: when it's time to drink, you drink alone, but everyone has a severe hangover in the morning! -

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

No one "on the top" wants Ukraine win. Because if Ukraine will win, next step will be demands to join NATO and EU then. Politico: Does America Want Ukraine to Defeat Russia? It Doesn’t Look That Way. https://www.politico.com/news/magazine/2024/09/18/america-ukraine-russia-biden-00179657 Wall Street Journal: Does Biden Want Ukraine to Win? https://www.wsj.com/articles/does-biden-want-ukraine-to-win-deal-russia-war-crimea-military-aid-630dbe60 The Hill: Why Biden can’t and won’t support a winning strategy for Ukraine and Israel https://thehill.com/opinion/national-security/4635968-why-biden-cant-and-wont-support-a-winning-strategy-for-ukraine-and-israel/ The Times: Does Joe Biden actually want Ukraine to win? https://www.thetimes.com/comment/columnists/article/nc14lawson-0f2ptrcc0 Wall Street Journal: No One Wants Ukraine to Win https://www.wsj.com/articles/neither-trump-nor-biden-want-ukraine-to-win-russia-war-military-aid-a2c77c02 The Hill: Biden inexplicably urges Ukraine not to be so effective fighting against Russia https://thehill.com/opinion/national-security/4557384-biden-inexplicably-urges-ukraine-to-be-less-effective-fighting-against-russia/ Foreign Policy: What Does America Want in Ukraine? https://foreignpolicy.com/2024/05/09/america-ukraine-forever-war-congress-aid/ Newsweek: Does the US Actually Want Ukraine to Defeat Russia? https://www.newsweek.com/us-want-ukraine-defeat-russia-putin-biden-zelensky-peace-talks-1846772 -

Too hot.

-

In fact, it does happen. But not very noticeably. The main reason is that many tourists, especially from the Asian part of Russia (east of the Ural Mountains), do not speak English or speak very little English. In addition, most Russian gays come in pairs or groups of friends and have no need to socialize in gay bars or find companions. After the Chinese and Malaysians, Russians are still the largest group of visitors to Thailand: starting from the end of October, when the weather in Russia starts to get worse, all Russian airlines increase the number of flights to Thailand from the summer 30-40 flights per week to 80-90, and from December 15 to February 1 to 120-150 flights per week. Over 2 million Russians visit Thailand per year, of which 1 million fly to Phuket, and of these, 0.5 million come from December 15 to February 15. Most of the guys from the bars know "hello" and "how are you?" in Russian.

-

-

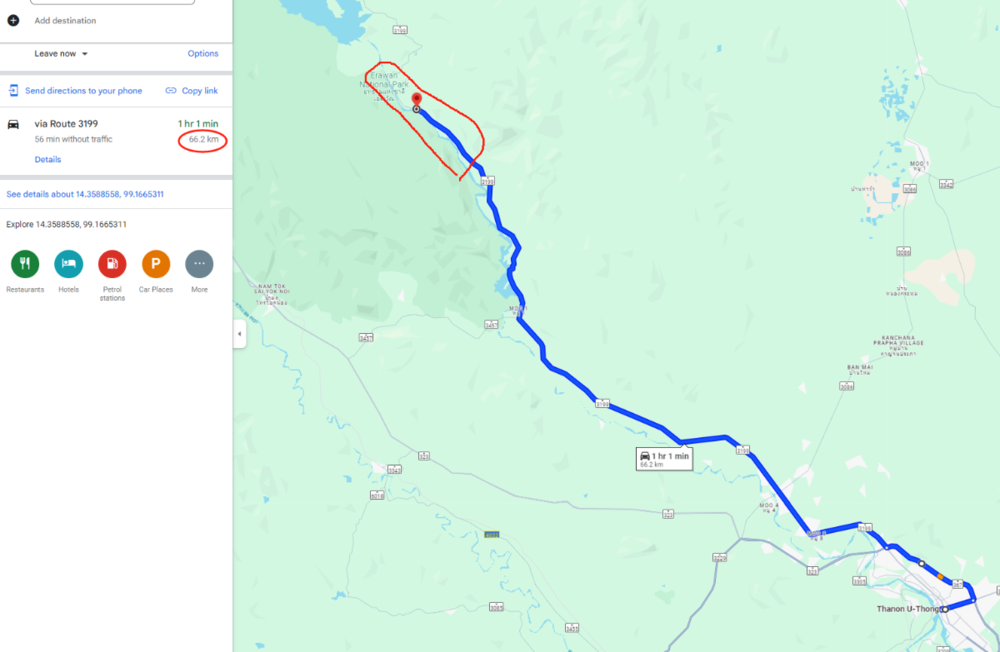

There are a lot of monkeys on Erawan waterfall. So many, that tourists are advised not to leave anything unattended while they take bath in waterfalls. Monkey are walking within tourists totally without any afraid. Glasses, cameras, cloths - everything will be stolen if you will leave something on the stones while taking bath.

-

It is quite useless on Kwai because there is national park around and almost no villages/towns.

-

All guys, listed on the site, are working. Ohh is working by weekends and Friday evenings.

-

Each guide on Siamroads has only 2 possible timeslots: 8 hours before sunset and 6 hours after sunset, you may choose any or both.

-

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

Bombs? On Russia? Where? Ukrainian air forces are died 2 years ago. -

Murderous Vlad Vlad promotes genocide for Ukraine

Moses replied to stevenkesslar's topic in Politics

dreams... dreams... -

I do it every 2-3 years with husband, for relax and detox from crazy temp of life. After 3-4 days there mind became clear from stresses.

-

Any phone with famous Leica camera lens will be good. Stabilization is big plus.

-

4-5 days in Siem Reap for Angkor, 2-3 nights in Kachanaburi in the floating villas on Kwai river on the border with national park and not far from Erawan waterfalls (worth day visit from villa). You should bring boy from Bangkok or PTT with you, because there are no cities close to that place.

-

By the way: almost the same attraction - market on the rail exists in Hanoi (Vietnam), but there are coffee shops and souvenir shops. Trains are going directly by narrow street. You can visit it with Siamroads guides in Hanoi.

-

Mac is the best if you are really interested in the history of Thailand, its culture. Mac has a specialized higher education - tourism and hospitality. He is one of the elite guides who have a license not only for his native province, but for the whole country. To confirm such a license, you need to pass a rather difficult exam every year. Mac is the youngest of the three. He is also a cat fan. Ohh is good if you love nature and modern technology - he is the owner of an eco-farm and a professional in design and photography. He is also good if you like to talk - he is a great listener. Sunny will entertain you all day if you prefer to listen. He is an excellent organizer and leader, his main job is teaching. As for the floating market, each of them has been there with tourists more than a dozen, if not a hundred times, so I advise you to choose based on their character and hobbies, since in terms of the required amount of knowledge and experience, all three are good. Personal advice: I recommend combining a visit to two markets - the floating one and the railway one - they are both in the same direction from Bangkok, to the west. If you plan to take a lot of photos or videos, then the classic strategy for the railway market is this: you arrive there about 15 minutes before the train, and shoot the train passing through the market from the ground. The train moves quite slowly, so as soon as you have taken a series of photos from the ground, you can get to the station, board the train and shoot the train passing through the market from the vestibule of the last carriage - there is a door with a window and you can see how the sellers restore the market, put up awnings and roll out stalls right behind the train.

-

Mac is only professional and licensed guide in Bangkok, who works daily Ohh works only by weekends, Sunny works by evenings and weekends, both are experienced freelancer guides (5+years), but have no license.

-

Good luck https://gobuddy.co/terms/?location=Bangkok

-

No, he is not available. Andy finished UNI and works as a lawyer now.

-

He said he will have new phone "prior Sep 24". Siamroads reply within next 12 hours, typically within next 1-2 hours if you send message btw noon and midnight by Bangkok time. Check your spam folder and check if your mailbox isn't full. I see all incoming mails and all replies and in whole 2024 year I see no one email what was left not replied. Typical reasons for not to get reply: mistyping in your mail address to reply your mailbox is within gmx.de domain (by some reason it decline emails from SiamRoads, everything is OK on our site, on the side of gmx.de they can't find problem already 7 years). Siamroads warns all senders about that directly above messaging form. our reply is in your spam folder your mailbox is full and server doesn't accept new emails If you will send me details of your email in PM I may check it more close. In whole September I see only one mail reply what for sure wasn't delivered - email was from Belgium domain BE and name before sign @ includes word "planet". If it is you, then let me know your correct email because we got reply "user doesn't exists". If you mean, what you made reservation and had no reply at all, then it is for sure issue with your mailbox or email address - you should receive reservation receipt within next 10 min, because robot does that 24/7. Confirmation may take up to 3-4 days - guys are with clients, some are in areas with low mobile coverage. That why Siamroads has minimal time to book tour 48 hours before tour.

-

Nope. Why you again moving everything to my personality? It is habits of blue lemmings? I had hopes what you'll get very clear idea: her nationality and gender are plus for her campaign.